|

|

Order by Related

- New Release

- Rate

Results in Title For portfolio

| A Personal Site for Domainers willing to showcase their domains. Listing and managing your domain at one place has never been so easy. A product by http://www.hotappz.com .. |

|

| This program is a version of a form that will assist you in tracking the fundamentals of your stock portfolio. It will run under Win 95, 98, Me, NT4,XP, & 2000. This program shows in one table the majority of fundamental information you can obtain from the Wall Street Journal, Investor's Business Daily and online sources so that you can keep an accurate weekly record of a given stock's performance. You can use a single page for each stock to track the stocks performance or use it to list and track your entire portfolio.

Printouts are professional looking and may be used by financial planners as they assist clients in keeping individual stock portfolio records. ..

|

|

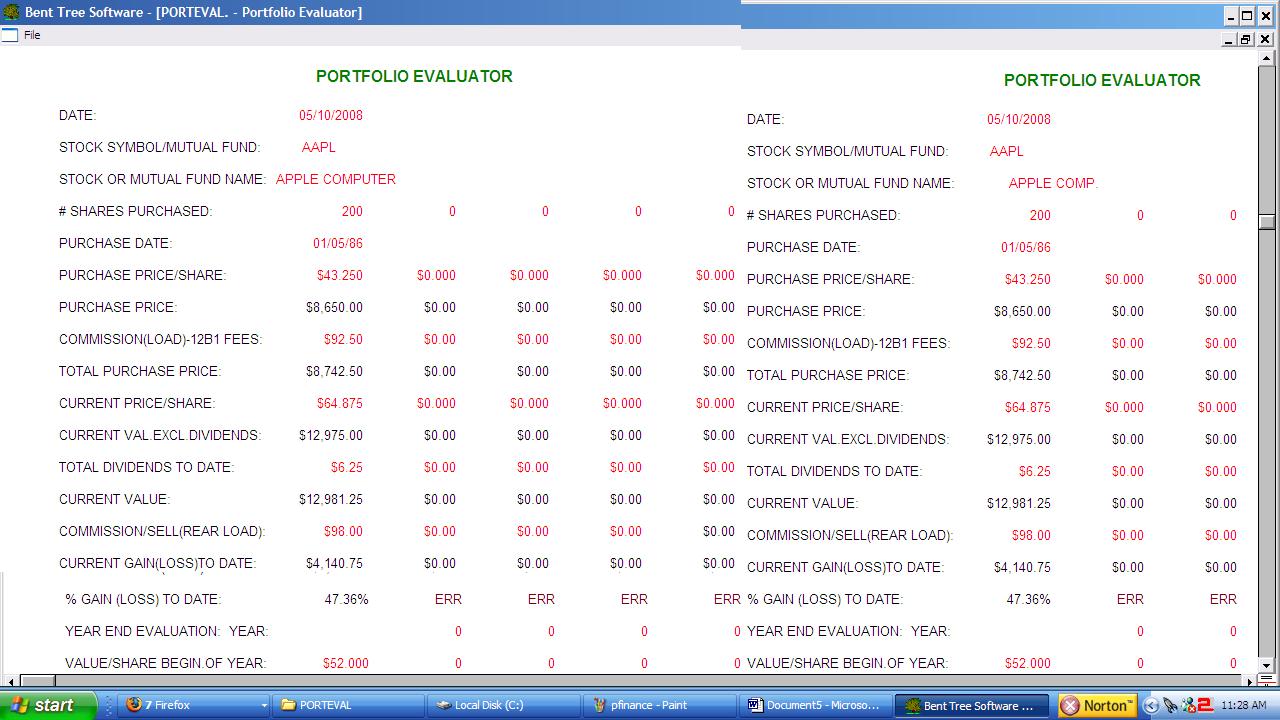

| This program is a form that will assist you in tracking your investments. This program tracks your investment's performance for stocks, bonds, mutual funds, etc. It allows you to evaluate the performance year-to-date or from initial purchase. .. |

|

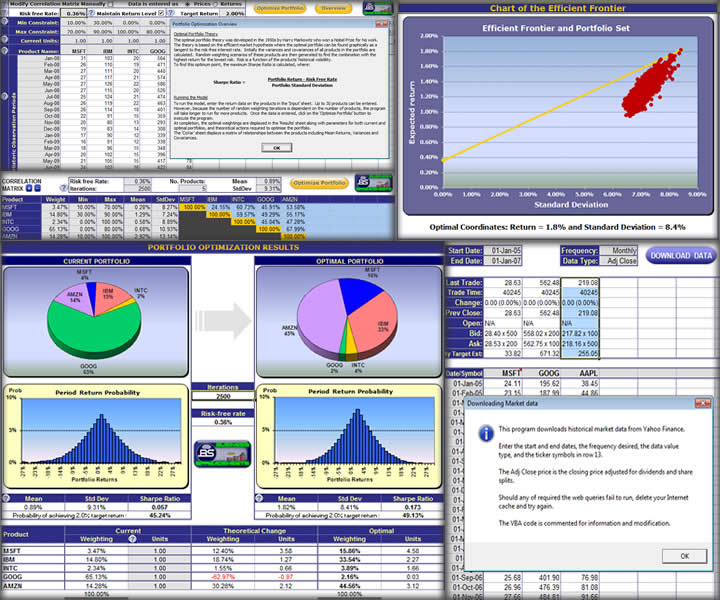

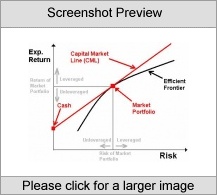

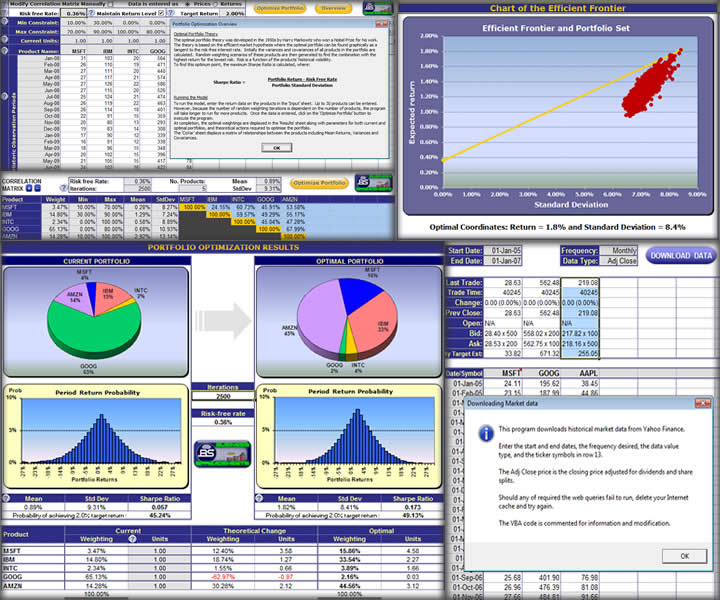

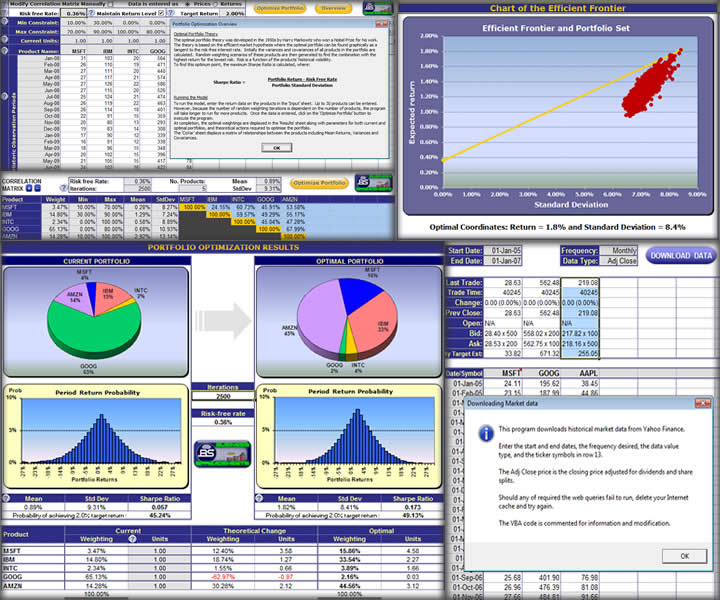

| The Portfolio Optimization model calculates the optimal capital weightings for a basket of financial investments that gives the highest return for the least risk. Results display action required and probability analysis through Monte Carlo simulation ..

|

|

| Are your trading accounts accurate? Can you bring up your profit & loss reports in a matter of minutes, should the tax people come calling? Would you be able to show detailed records of your trades in under five minutes?

OTrader 4.1 is a streamlined, easy-to-use portfolio management tool for stock, option, warrant, future and CFD traders. The new features in OTrader 4.1 allow you go way beyond your standard excel spread sheets by giving you advanced reporting and trade analysis.

OTrader Portfolio Management Software allows you to:

* Plan your trades before placing your capital at risk.

* Trade your plan by using the trading plan check list, improving your trading discipline and potential returns.

* Manage your trades including stop losses, profit targets and end of financial year reporting.

* Review your trades so you can easily establish your trading strengths and weakness.

OTrader 4.1 provides everything you need as a private trader to manage your portfolio:

* Quick and simple trade entry screens that make keeping your portfolio up-to-date fast and efficient.

* Powerful reporting that details your exact financial position allowing you to make informed trading decisions. No more on-the-fly un-thought out panic decisions.

* Ability to track CFD's, Stocks, Options, Warrants, Futures, Managed Funds, Dividends and trade financing costs.

* Update trade prices for free from yahoo finance or use DDE to connect to your existing data source.

By creating unlimited accounts and systems you gain complete control over your trading to analyse each detail of your performance. By assigning trades to a specific trading system you gain the capability to drill down on your results exposing the strengths and weakness of your trading system.

* Advanced trade analysis allows you to determine the most profitable aspects of your trading so that you know where to place your money for maximum results. .. |

|

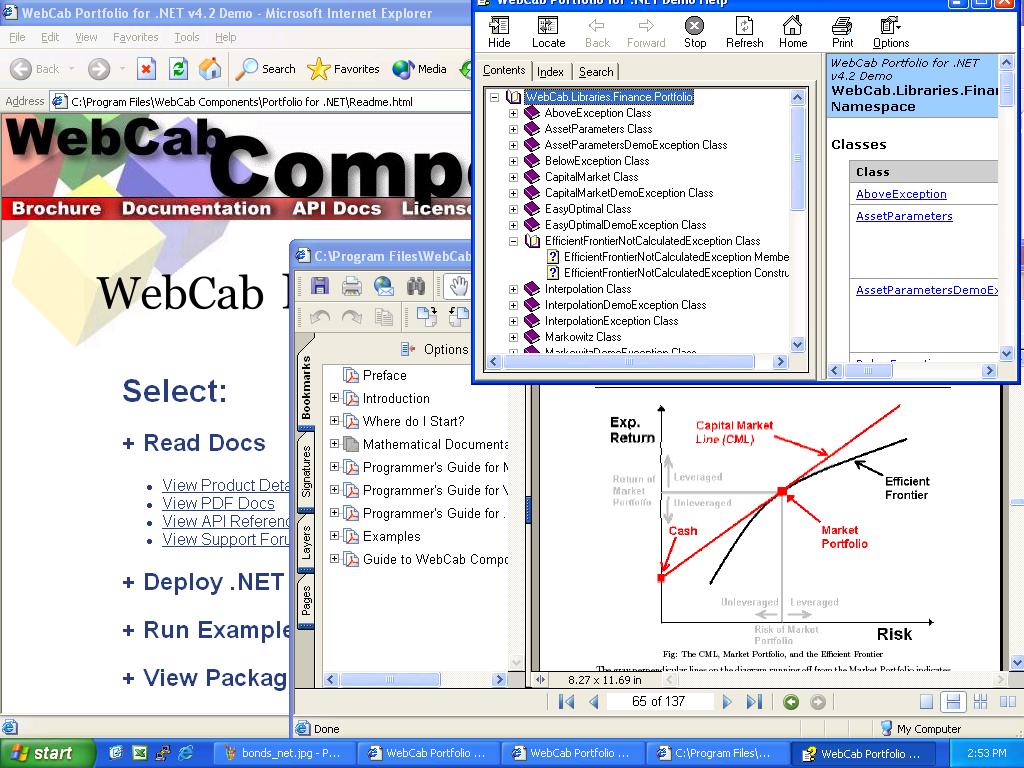

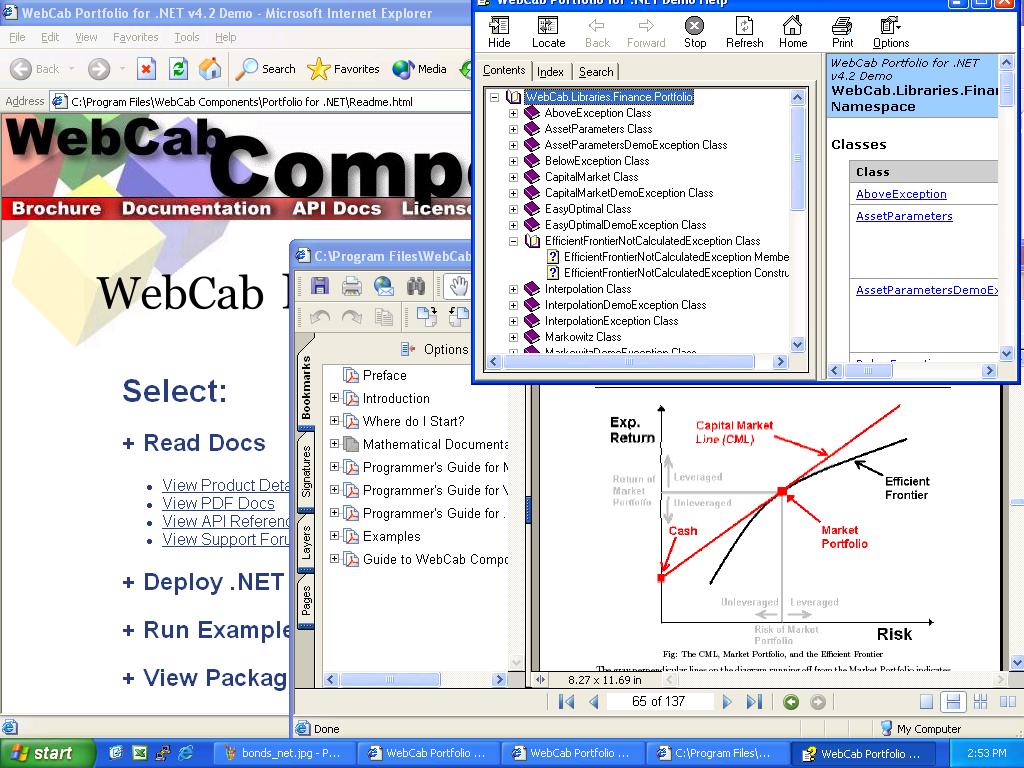

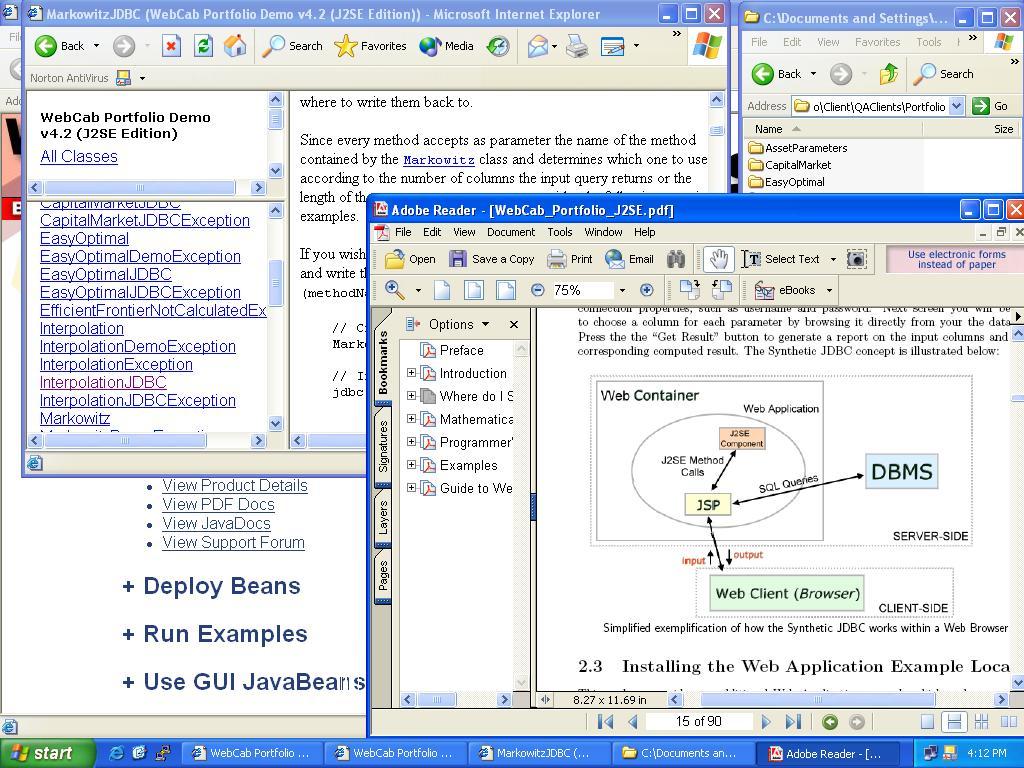

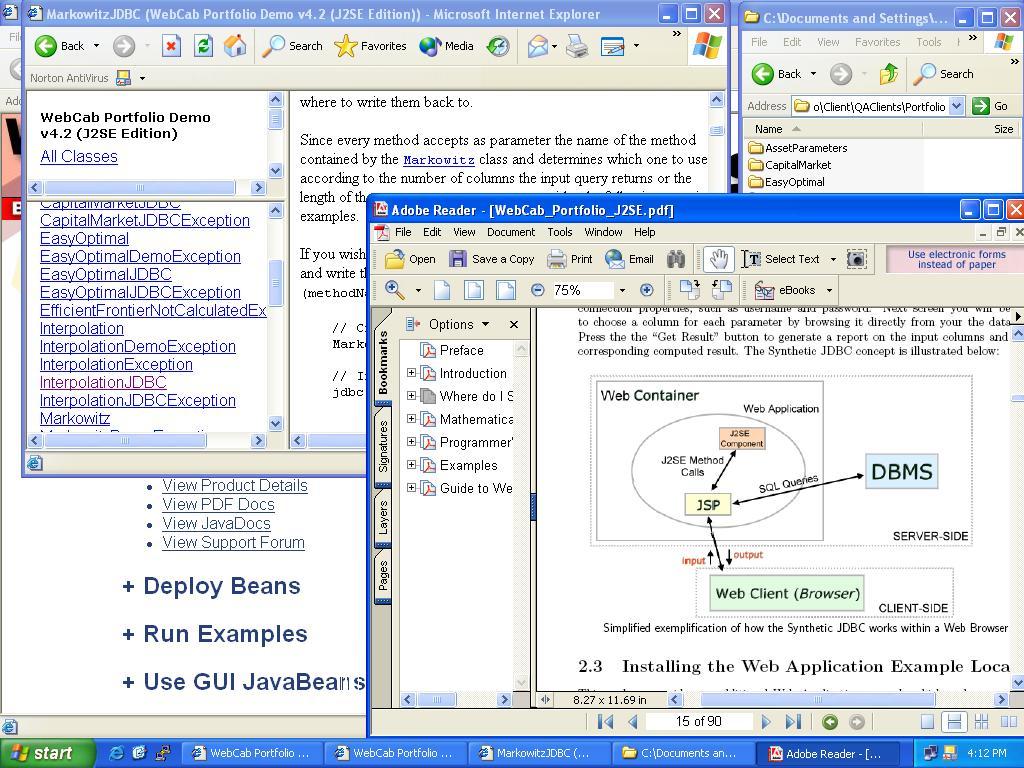

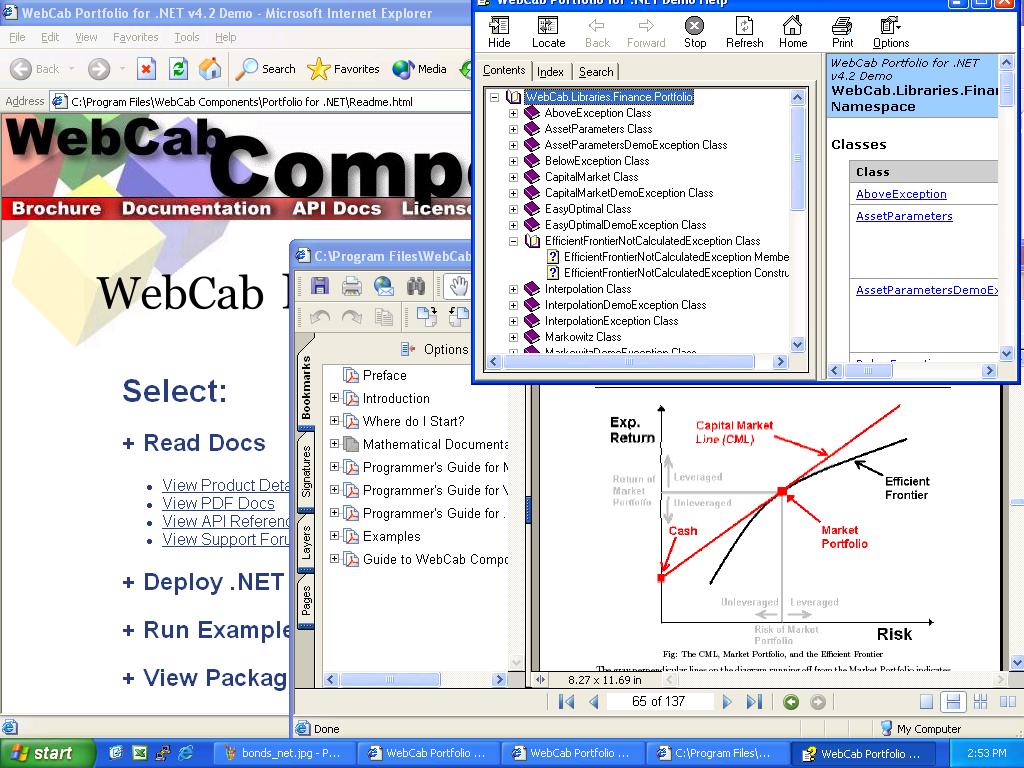

| .NET, COM and XML Web service implementation of Markowitz Theory and the CAPM to construct the optimal portfolio with/without asset weight constraints with respect to the risk, return or investors utility function. ..

|

|

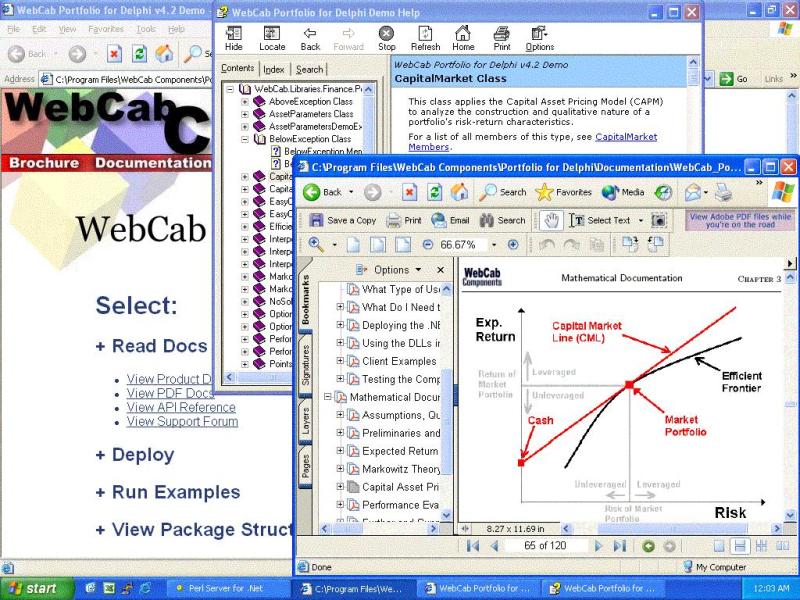

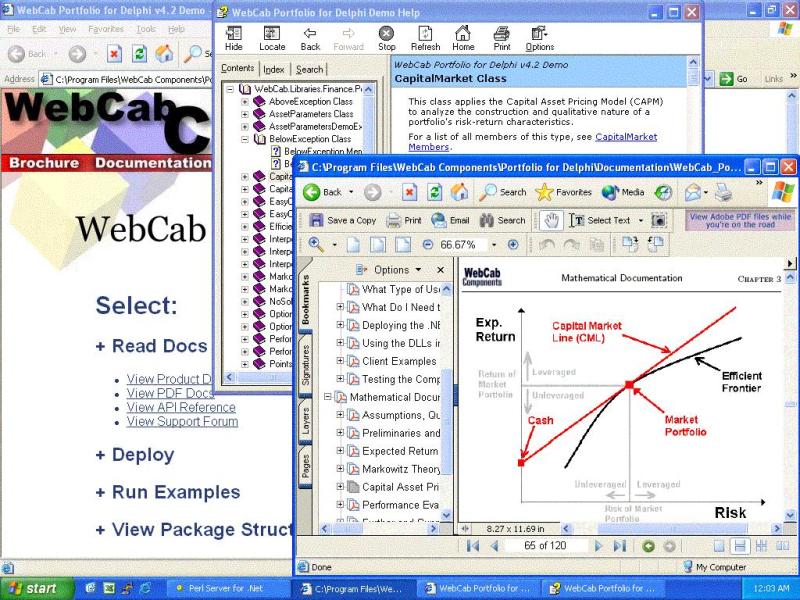

| 3-in-1: Delphi, COM and XML Web service implementation of Markowitz Theory and the CAPM to construct the optimal portfolio with/without asset weight constraints with respect to the risk, return or investors utility function. Incl. Perform Eval. .. |

|

| The Portfolio Optimization model calculates the optimal capital weightings for a basket of investments that gives the highest return for the least risk. The unique design of the model enables it to be applied to either financial instrument or business portfolios. The ability to apply optimization analysis to a portfolio of businesses represents an excellent framework for driving capital allocation, investment, and divestment decisions. The key features of the Portfolio Optimisation template include - Ease and flexibility of input, with embedded help prompts. - Ability to specify the number of units held in each product or business. - Specify minimum and maximum constraints for the optimised portfolio. - Unique Maintain Current Return Level option to ensure that return is not deteriorated at the expense of risk. - Modify correlation matrix and portfolio dynamics before optimization process. - Intuitive graphical result display with Monte Carlo simulation, including probability analysis on specified Target return level. (Requires Microsoft Excel 97 or above) .. |

|

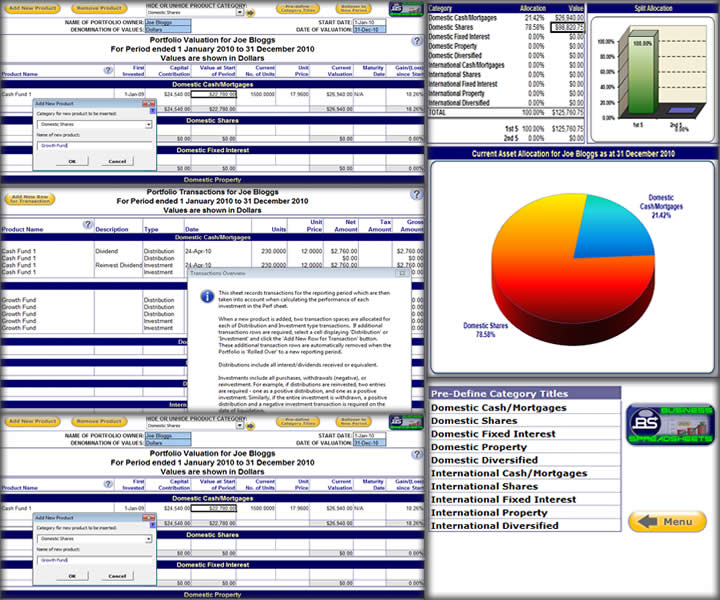

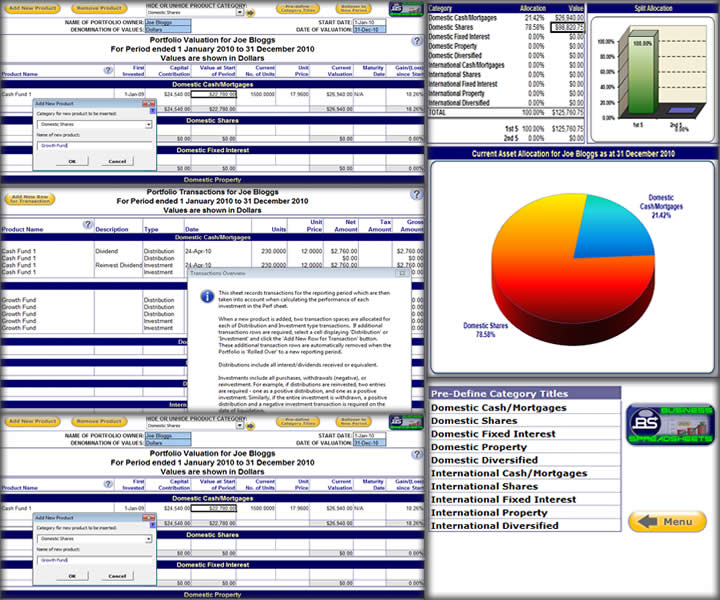

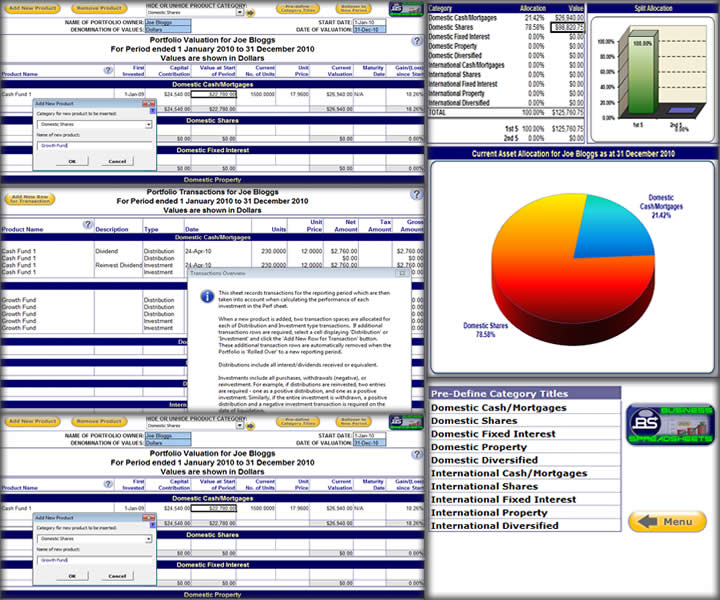

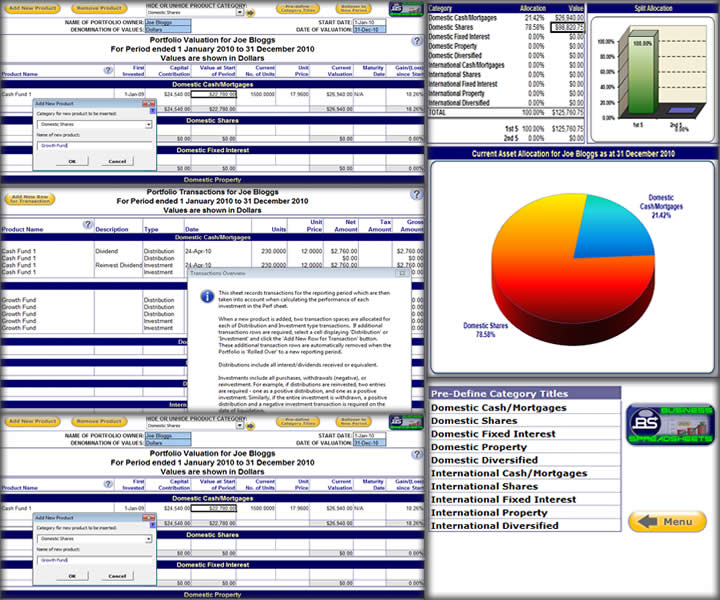

| The Portfolio Performance Monitoring model enables the ongoing monitoring and periodic valuation of a portfolio of financial investments. Amount and timing of investment and divestment transactions are taken into account in performance calculations. .. |

|

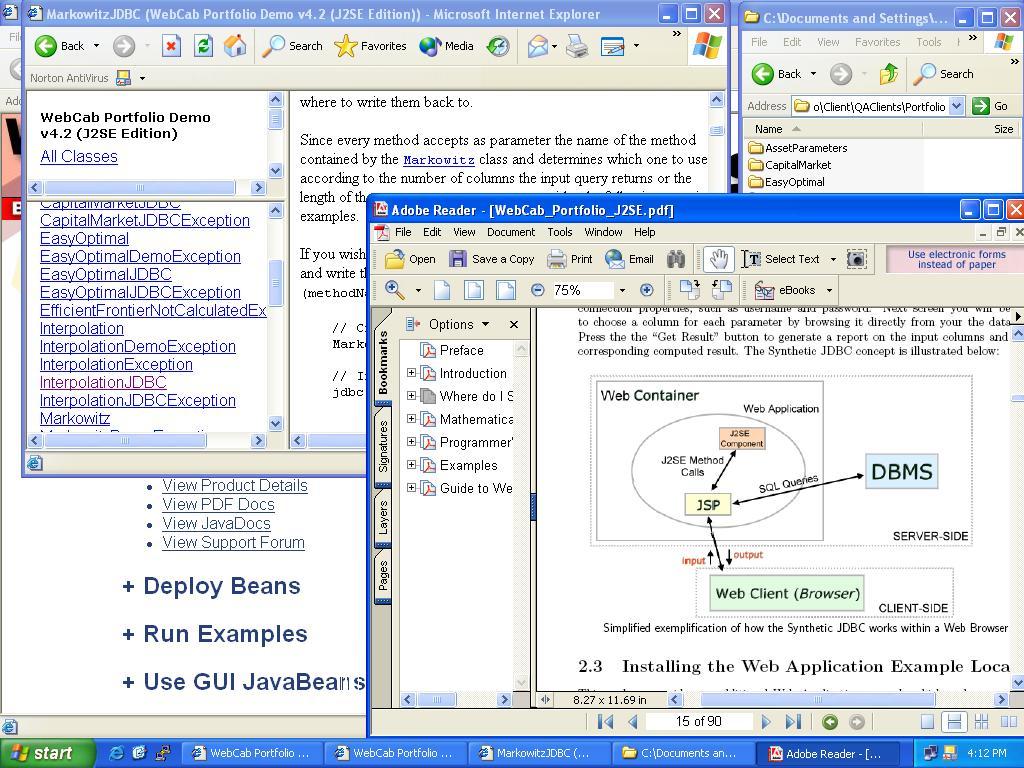

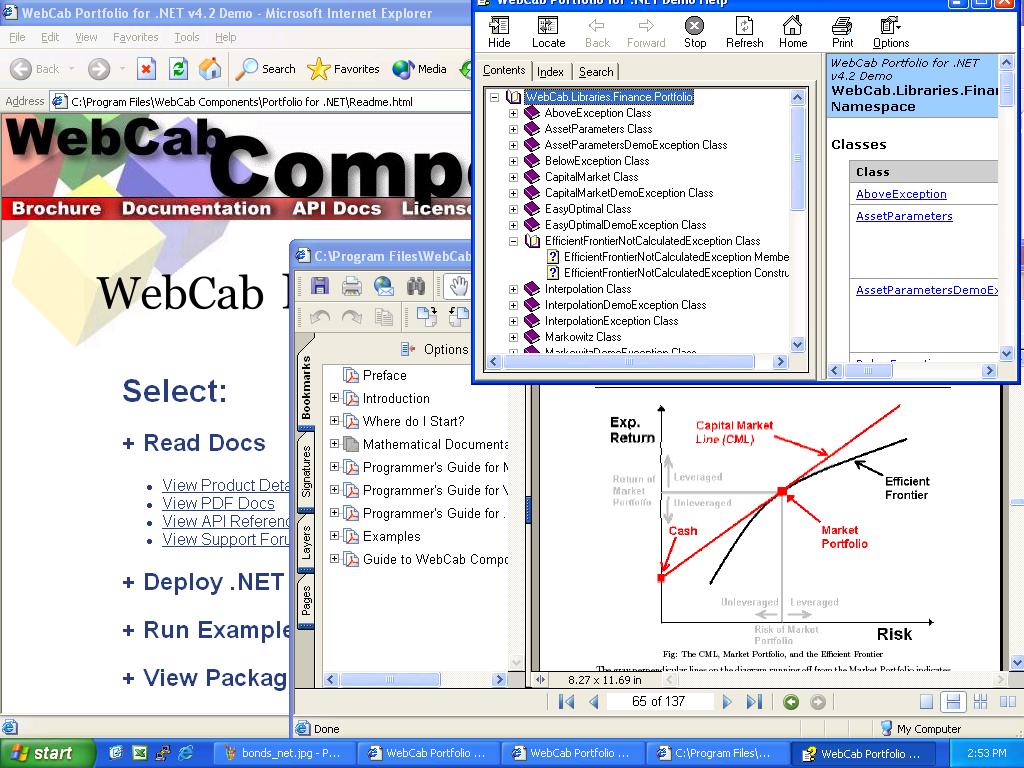

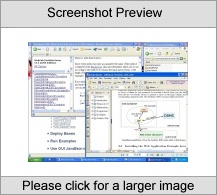

| Apply the Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints with respect to Markowitz Theory by giving the risk, return or investors utility function; or with respect to CAPM by given the risk, return or Market Portfolio weighting. Also includes Performance Evaluation, extensive auxiliary classes/methods including equation solve and interpolation procedures, analysis of Efficient Frontier, Market Portfolio and CML. .. |

|

Results in Keywords For portfolio

| Apply the Markowitz Theory and CAPM to construct the optimal portfolio with/without asset weight constraints with respect to the risk, return or investors utility function. Also Performance Eval, interpolation, analysis of Efficient Frontier and CML... |

|

| .NET, COM and XML Web service implementation of Markowitz Theory and the CAPM to construct the optimal portfolio with/without asset weight constraints with respect to the risk, return or investors utility function...

|

|

| Apply Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints with respect to Markowitz Theory by giving the risk, return or investors utility function; or with respect to CAPM by given the risk, return or Market Portfolio weighting. Also includes Performance Evaluation, extensive auxiliary classes/methods including equation solve and interpolation procedures, analysis of Efficient Frontier, Market Portfolio and CML... |

|

| Apply the Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints with respect to Markowitz Theory by giving the risk, return or investors utility function; or with respect to CAPM by given the risk, return or Market Portfolio weighting. Also includes Performance Evaluation, extensive auxiliary classes/methods including equation solve and interpolation procedures, analysis of Efficient Frontier, Market Portfolio and CML...

|

|

| Apply Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints with respect to Markowitz Theory by giving the risk, return or investors utility function; or with respect to CAPM by given the risk, return or Market Portfolio weighting. Also includes Performance Evaluation, extensive auxiliary classes/methods including equation solve and interpolation procedures, analysis of Efficient Frontier, Market Portfolio and CML... |

|

| Apply the Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints with respect to Markowitz Theory by giving the risk, return or investors utility function; or with respect to CAPM by given the risk, return or Market Portfolio weighting. Also includes Performance Evaluation, extensive auxiliary classes/methods including equation solve and interpolation procedures, analysis of Efficient Frontier, Market Portfolio and CML...

|

|

| PortfolioTK is a stock portfolio manager that provides both accurate quantitative statistics and advanced charting. It includes overall portfolio equity curve performance with risk analysis, trade log entry supporting partial position matching of both long and short trades, and a charting database with over 35+ technical indicators. Not only that but you can use PortfolioTK's reporting features to see how your portfolio has been performing against the major benchmark indices... |

|

| An Excel template for the ongoing monitoring of your financial investment portfolio... |

|

| Delphi add-in Component and XML Web service implementation offering the application of the Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints with respect to Markowitz Theory by giving the risk, return or investors utility function; or with respect to CAPM by given the risk, return or Market Portfolio weighting. Also includes Performance Evaluation, extensive auxiliary classes/methods including equation solve and interpolation procedures, analysis of Efficient Frontier, Market Portfolio and CML... |

|

| FREE Quote Watchlist Software for over 50 exchanges worldwide. Keep track of your trades with this easy to use quote watchlist tool, data feeds are free so you can monitor your trades with zero cost. Anfield Capital Pty Ltd www.stator-afm.com.. |

|

Results in Description For portfolio

| The Portfolio Performance Monitoring model enables the ongoing monitoring and periodic valuation of a portfolio of financial investments. Amount and timing of investment and divestment transactions are taken into account in performance calculations... |

|

| Apply the Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints with respect to Markowitz Theory by giving the risk, return or investors utility function; or with respect to CAPM by given the risk, return or Market Portfolio weighting. Also includes Performance Evaluation, extensive auxiliary classes/methods including equation solve and interpolation procedures, analysis of Efficient Frontier, Market Portfolio and CML...

|

|

| Apply Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints with respect to Markowitz Theory by giving the risk, return or investors utility function; or with respect to CAPM by given the risk, return or Market Portfolio weighting. Also includes Performance Evaluation, extensive auxiliary classes/methods including equation solve and interpolation procedures, analysis of Efficient Frontier, Market Portfolio and CML... |

|

| Apply the Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints with respect to Markowitz Theory by giving the risk, return or investors utility function; or with respect to CAPM by given the risk, return or Market Portfolio weighting. Also includes Performance Evaluation, extensive auxiliary classes/methods including equation solve and interpolation procedures, analysis of Efficient Frontier, Market Portfolio and CML...

|

|

| Apply Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints with respect to Markowitz Theory by giving the risk, return or investors utility function; or with respect to CAPM by given the risk, return or Market Portfolio weighting. Also includes Performance Evaluation, extensive auxiliary classes/methods including equation solve and interpolation procedures, analysis of Efficient Frontier, Market Portfolio and CML... |

|

| The Portfolio Optimization model calculates the optimal capital weightings for a basket of investments that gives the highest return for the least risk. The unique design of the model enables it to be applied to either financial instrument or business portfolios. The ability to apply optimization analysis to a portfolio of businesses represents an excellent framework for driving capital allocation, investment, and divestment decisions. The key features of the Portfolio Optimisation template include - Ease and flexibility of input, with embedded help prompts. - Ability to specify the number of units held in each product or business. - Specify minimum and maximum constraints for the optimised portfolio. - Unique Maintain Current Return Level option to ensure that return is not deteriorated at the expense of risk. - Modify correlation matrix and portfolio dynamics before optimization process. - Intuitive graphical result display with Monte Carlo simulation, including probability analysis on specified Target return level. (Requires Microsoft Excel 97 or above)..

|

|

| Delphi add-in Component and XML Web service implementation offering the application of the Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints with respect to Markowitz Theory by giving the risk, return or investors utility function; or with respect to CAPM by given the risk, return or Market Portfolio weighting. Also includes Performance Evaluation, extensive auxiliary classes/methods including equation solve and interpolation procedures, analysis of Efficient Frontier, Market Portfolio and CML... |

|

| This program is a version of a form that will assist you in tracking the fundamentals of your stock portfolio. It will run under Win 95, 98, Me, NT4,XP, & 2000. This program shows in one table the majority of fundamental information you can obtain from the Wall Street Journal, Investor's Business Daily and online sources so that you can keep an accurate weekly record of a given stock's performance. You can use a single page for each stock to track the stocks performance or use it to list and track your entire portfolio.

Printouts are professional looking and may be used by financial planners as they assist clients in keeping individual stock portfolio records... |

|

| New Features Include:Advance reporting features Enhanced taxation reporting Foreign currency calculator RSP analyzer Loan calculator Retirement calculatorTodays investors know better then to put all their eggs in one basket. Likewise, their investments are often with several banks and investment firms. The Investment Tracking System can track and analyze all of your investments. Whether the investor has all of their investments with one or more firms, the Investment Tracking System provides detailed and concise information on your entire financial portfolio. You the investor are in the drivers seat, and as such, you have complete control over portfolio and financial holdings.Highlights:To provide the investor with a complete and detailed picture of their total investment portfolio. To be flexible. The Investment Tracking System allows an investor to track their investments on their own update frequency. The portfolio can be updated weekly, monthly, quarterly etc. To save the investor time by providing fast and easy investment updates. To provide quick navigation and manipulation of the financial portfolio, so you may reach required information quickly and easily. To provide a minimal learning curve, that allows the software to be learnt quickly, and to be used efficiently. The Investment Tracking System contains many help menu "Hot Spots", that provides help and suggestions for any situations. To provide numerous detailed financial graphs, charts and reports that give the investor a graphical representation of what their portfolio looks like. To be easy to use no matter how much computer experience. Although the Investment Tracking System is easy to use, it still provides the user with advanced system features. .. |

|

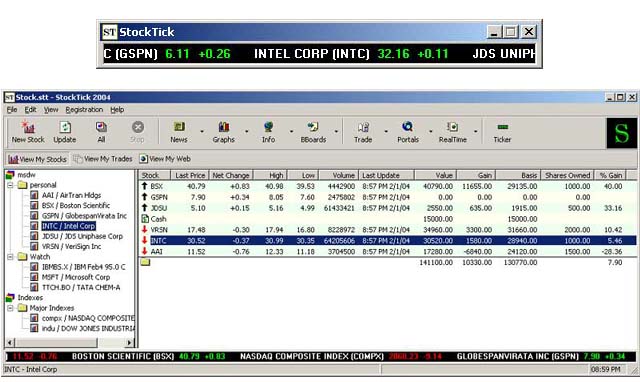

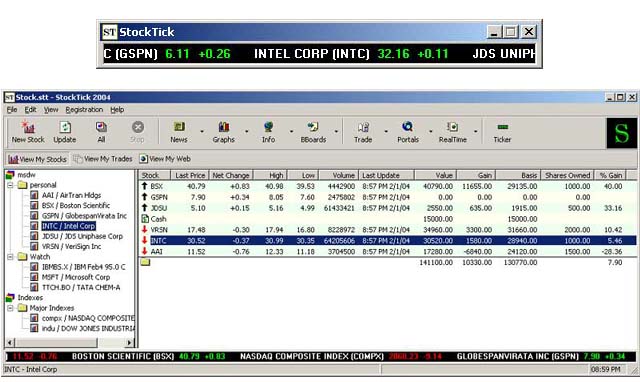

| StockTick 2005 is a free stock market ticker and portfolio manager to securely track your stocks and trades. Real time and international quotes included in stock ticker. See why people are saying it is the best stock quote portfolio tracking software program on the market for the past 9 Years! Full featured with no limitations. Use as long as you like. Register to remove ads, otherwise full version... |

|

Results in Tags For portfolio

| Apply the Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints with respect to Markowitz Theory by giving the risk, return or investors utility function; or with respect to CAPM by given the risk, return or Market Portfolio weighting. Also includes Performance Evaluation, extensive auxiliary classes/methods including equation solve and interpolation procedures, analysis of Efficient Frontier, Market Portfolio and CML... |

|

| Apply the Markowitz Theory and CAPM to construct the optimal portfolio with/without asset weight constraints with respect to the risk, return or investors utility function. Also Performance Eval, interpolation, analysis of Efficient Frontier and CML...

|

|

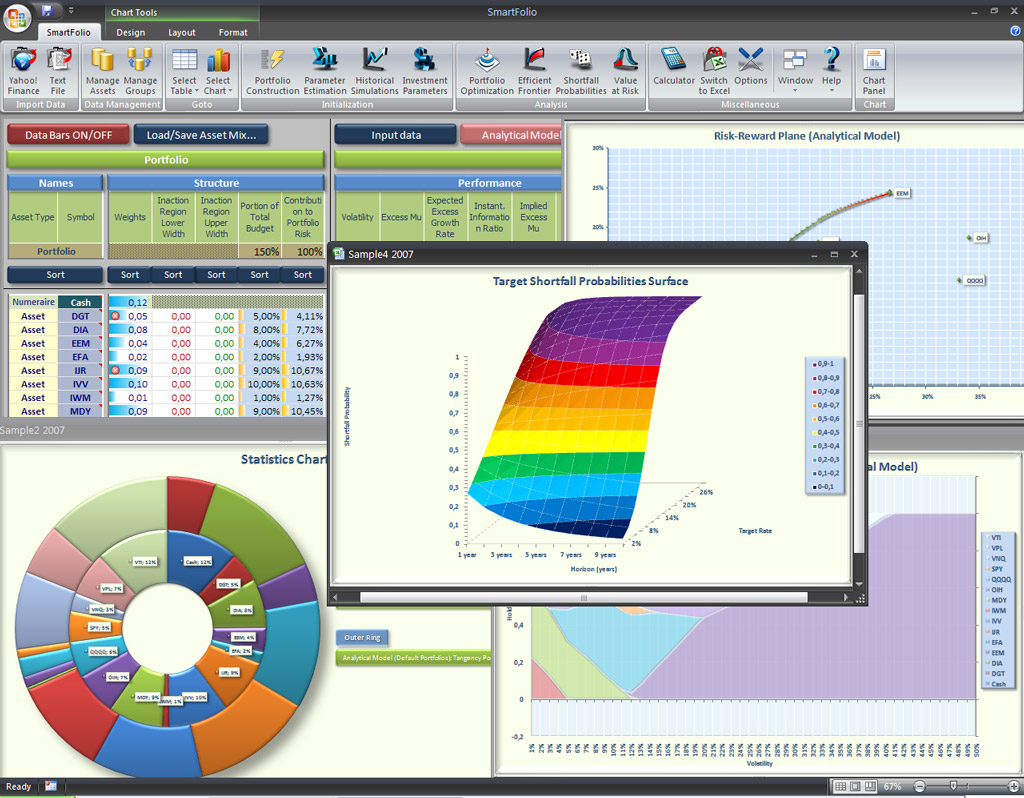

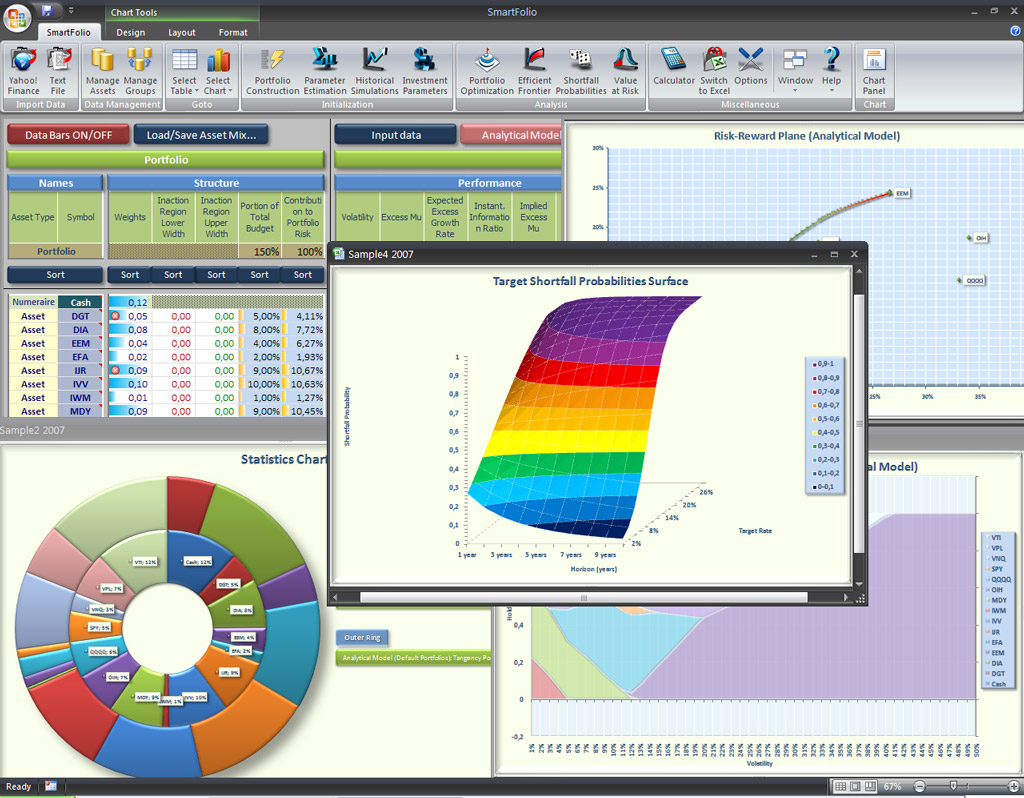

| SmartFolio is a state-of-the-art asset allocation software aimed at all types of investors and investment professionals. It contains advanced portfolio optimization and risk management algorithms, based on latest achievements in portfolio theory... |

|

| Are your trading accounts accurate? Can you bring up your profit & loss reports in a matter of minutes, should the tax people come calling? Would you be able to show detailed records of your trades in under five minutes?

OTrader 4.1 is a streamlined, easy-to-use portfolio management tool for stock, option, warrant, future and CFD traders. The new features in OTrader 4.1 allow you go way beyond your standard excel spread sheets by giving you advanced reporting and trade analysis.

OTrader Portfolio Management Software allows you to:

* Plan your trades before placing your capital at risk.

* Trade your plan by using the trading plan check list, improving your trading discipline and potential returns.

* Manage your trades including stop losses, profit targets and end of financial year reporting.

* Review your trades so you can easily establish your trading strengths and weakness.

OTrader 4.1 provides everything you need as a private trader to manage your portfolio:

* Quick and simple trade entry screens that make keeping your portfolio up-to-date fast and efficient.

* Powerful reporting that details your exact financial position allowing you to make informed trading decisions. No more on-the-fly un-thought out panic decisions.

* Ability to track CFD's, Stocks, Options, Warrants, Futures, Managed Funds, Dividends and trade financing costs.

* Update trade prices for free from yahoo finance or use DDE to connect to your existing data source.

By creating unlimited accounts and systems you gain complete control over your trading to analyse each detail of your performance. By assigning trades to a specific trading system you gain the capability to drill down on your results exposing the strengths and weakness of your trading system.

* Advanced trade analysis allows you to determine the most profitable aspects of your trading so that you know where to place your money for maximum results...

|

|

| The Portfolio Optimization model calculates the optimal capital weightings for a basket of financial investments that gives the highest return for the least risk. Results display action required and probability analysis through Monte Carlo simulation.. |

|

| FXWitz Multimedia Portfolio: Makes, Publish online, Update Your Multimedia Portfolio with the images of new works every time you desire at zero cost independently all in Flash with a few click. From today WITH FXWitz Multimedia Portfolio You can: Have yours work on-line, Take advantage from the new communication technologies, Eliminate the costs for webmaster or webdesigner.

FXWitz Multimedia Portfolio is thought for you: quality design, advanced technologies. FXWitz Multimedia Portfolio IS easy to use: it doesn't need technical skills...

|

|

| The Portfolio Performance Monitoring model enables the ongoing monitoring and periodic valuation of a portfolio of financial investments. Amount and timing of investment and divestment transactions are taken into account in performance calculations... |

|

| The Portfolio Optimization model calculates the optimal capital weightings for a basket of investments that gives the highest return for the least risk. The unique design of the model enables it to be applied to either financial instrument or business portfolios. The ability to apply optimization analysis to a portfolio of businesses represents an excellent framework for driving capital allocation, investment, and divestment decisions. The key features of the Portfolio Optimisation template include - Ease and flexibility of input, with embedded help prompts. - Ability to specify the number of units held in each product or business. - Specify minimum and maximum constraints for the optimised portfolio. - Unique Maintain Current Return Level option to ensure that return is not deteriorated at the expense of risk. - Modify correlation matrix and portfolio dynamics before optimization process. - Intuitive graphical result display with Monte Carlo simulation, including probability analysis on specified Target return level. (Requires Microsoft Excel 97 or above).. |

|

| .NET, COM and XML Web service implementation of Markowitz Theory and the CAPM to construct the optimal portfolio with/without asset weight constraints with respect to the risk, return or investors utility function... |

|

| Apply Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints with respect to Markowitz Theory by giving the risk, return or investors utility function; or with respect to CAPM by given the risk, return or Market Portfolio weighting. Also includes Performance Evaluation, extensive auxiliary classes/methods including equation solve and interpolation procedures, analysis of Efficient Frontier, Market Portfolio and CML... |

|

Related search : portfolio j2se editionwebcab portfolio j2seportfolio optimization,portfolio management,investment portfolio managementportfolio optimization,portfolio optimization modelmultimedia portfoliofxwitz multimedia,fxwitz multimedia portfoliophoto portfolio Order by Related

- New Release

- Rate

digital portfolio -

flash portfolio -

teacher portfolio -

portfolio analyzer -

portfolio optimisation -

|

|